I’ve decided to start running a new series of posts where I take a look at the mathematics of goldmaking. The idea is to look at the numbers, both in the game and the sales related numbers and see what we find. In the first post today we will take a look at prospecting.

RNG and expected value

Prospecting is something that has often been very profitable. It is also an activity with significant variability as you get a random number and types of gems based on some distribution. Over the years this has been done in a lot of different ways resulting in very large differences across expansions. The most important thing to know is how many ores you have to prospect to be reasonably sure you get the expected value back.

Modeling prospecting

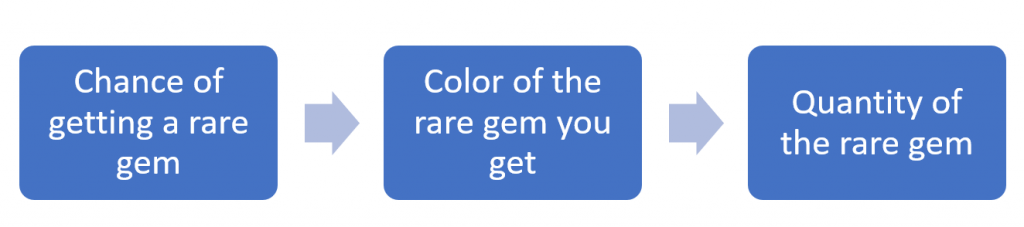

When you prospect 5 ores in WoW the game usually does several different checks. This varies between ores and if it can drop more than one quality of gem. First it checks if you get gems of a specific quality. Then it will determine the quantity you get of gems of that quality and the colour of those gems. It does not really matter in which order these checks happen, as it is easily run with a simple random sample and pre-determined distribution. We can model it either way as a series of three checks. If an ore type can prospect into several gem qualities it will run this check for both of them.

The important par here is the quantity check in particular. If you can get more than one gem this will have a significant impact on the average number you get per prospect, but it will not affect the chance of getting that gem color on a per prospect basis. if the chance of getting the gem type is low, then the variance will start increasing very rapidly.

This might make more sense if we take a look at two concrete examples, so let’s do it.

Felslate Legion

Felslate in legion could generate both uncommon and rare gems. At the time only the rare gems really held value, so that’s what you were hunting for. The rate of rare gems per prospect was about 17%. The way rare gem prospecting worked in Legion for Felslate was that you had a 5 % chance of getting rare gems, and then you got between 2 to 5 rare gems of the current colour according to the gem bits. With just a 5% chance of even getting a rare gem, the chance of prospecting one specific color was as low as 1 % per prospect.

If the value difference between rare gems is significant this means you need to prospect a lot of ore. To get close to the correct total rate of rares you needed to prospect more than 5000 ore. If you also wanted to be fairly certain you got the right distribution between colors the numbers goes up even more.

Simulating a felslate like ore

To get a better idea about how this can shake out I made a Monte Carlo simulation model to see how the variance could be.

In this example I use assumptions that are similar to felslate, in that you have a 15 % chance of getting a rare gem (which is way higher than the number for felslate). Then it can turn into any one of the 6 different gem variations. All of the rare gems are worth the same amount of money, except one of them, which is worth double the others. In actual situations the most valuable gems have often been more than 3-10 times as valuable as the least valuable ones, so this is even slightly “optimistic”.

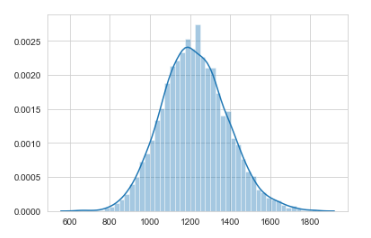

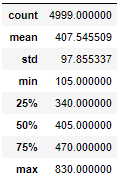

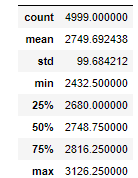

I ran 5000 simulations of batches of 2000 ore. The histogram below shows the distribution in terms of total gold value of the gems you got.

As we can see there is a pretty wide spread of results. We are mot concerned of course with avoiding ending up with batches where we do not make gold. The worst sample is just 50% of the average value, and would probably lose money. The standard deviation is at 13%, so you need to expect at least a 13% variability in value if you prospect 2000 of this hypothetical ore.

Sensitivity to the chance of getting one or more gems

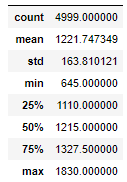

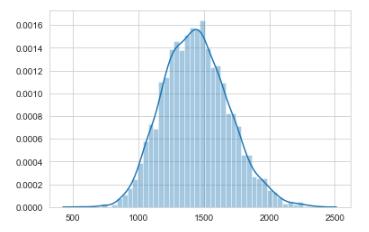

Overall these are not the most skewed numbers though. Felslate was actually much worse, since there was just a 5% chance of getting a rare gems, compared to the 15% chance in the last simulation. If we set the chance to 5% like felslate we get the histogram below.

As we can see this is much wider, indicating a much larger spread. This time around the lowest value is under 30% of the average value. Keep in mind as well that we are just assuming a value difference between the gems where one gem is worth 2 times what the others are worth. The Standard deviation is at 23%, indicating a fairly large amount of variation, and significantly more than the first example.

Sensitivity to gem values

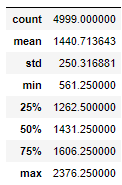

If we spice it up by changing the value of gems a bit we can get even more variance. Let’s look at a gem where everything is worth the same, except one expensive gem that is worth 4 times the baseline, and one cheap gem that is worth a quarter of the baseline. We set the chance of getting a gem back up to 15% so compare this with the first example.

Once again it is significantly wider than the first one. The worst sample is a little under 38% of the average prospecting result here, so not quite as high variance as with the felslate drop chance, but it is still significant. The standard Deviation is 17.3 % so significantly higher than the initial example.

What about Osmenite?

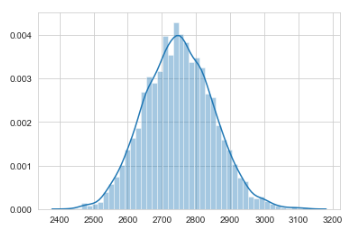

For Osmenite the only variation is the color of the gem and whether or not you get a leviathan’s eye. Typically the sage agates and the Azsharines have had much higher value than the other gems, but a way lower drop chance. If we set the value of the two rare gems to 4 times the value of the regular colored gems we can get a good estimation of the impact of color variation. We also have to include leviathan’s eyes that we will price at the baseline level with a 15% chance of happening.

Since you always get an epic gem the variance is actually fairly low. Getting a valuable gem on every prospect cuts down the required sample size massively. This sample has by far the lowest standard deviation at just 3%. It does seem that Blizzard learned from Felslate and this was also the case back in Legion where Empyrium was much less prone to bad RNG. The worst sample is also sitting at 88% of the mean, which is pretty great. The pricing assumptions are not completely correct, but they are close enough to reality on a lot of realms.

What does all this mean?

The number of ores you need to prospect to be guaranteed will vary a lot between ore types and expansions. For the most part you will have to prospect thousands to be fairly certain you make a profit. The exact mechanics will vary a lot and depends on the chance of getting the right quality gems, variations in the quantity of gems you get and the difference in value between gems. If the chance of getting the right quality is low, the variation in quantity is high or the difference in value is high then the variance in value from prospecting ore goes up and you need to prospect much more to guarantee you turn a profit.

Blizzard has shied away from making prospecting too variable in the last couple of expanions, so most likely you can make a profit at 2000 ore in the future assuming prospecting actually is profitable. Either way I’m excited for redoing this sort of analysis in Shadowlands for the new ores we get there! There’s a reason I’ve almost always had jewelcrafting on my main!